Strategic Luxury: Why Van Cleef & Arpels Pieces Are Essential Portfolio Diversification Assets

Van Cleef & Arpels merges artistry with investment potential, offering pieces that appreciate in value…

Strategic Watch Investing: Why Rolex’s 800,000 Units and AP’s Boutique Exclusivity Drive Market Premiums

Discover why luxury watches from Rolex and Audemars Piguet represent both status symbols and investment…

Investing in Horological Excellence: The Complete Guide to Patek Philippe Nautilus Returns

Explore the Patek Philippe Nautilus as a premier investment asset with pre-owned models starting at…

Independent Watchmakers: The New Frontier in Luxury Investment with 45% Annual Returns

Independent watchmakers redefine luxury timepieces through limited production, craftsmanship, and innovation, creating investment opportunities with…

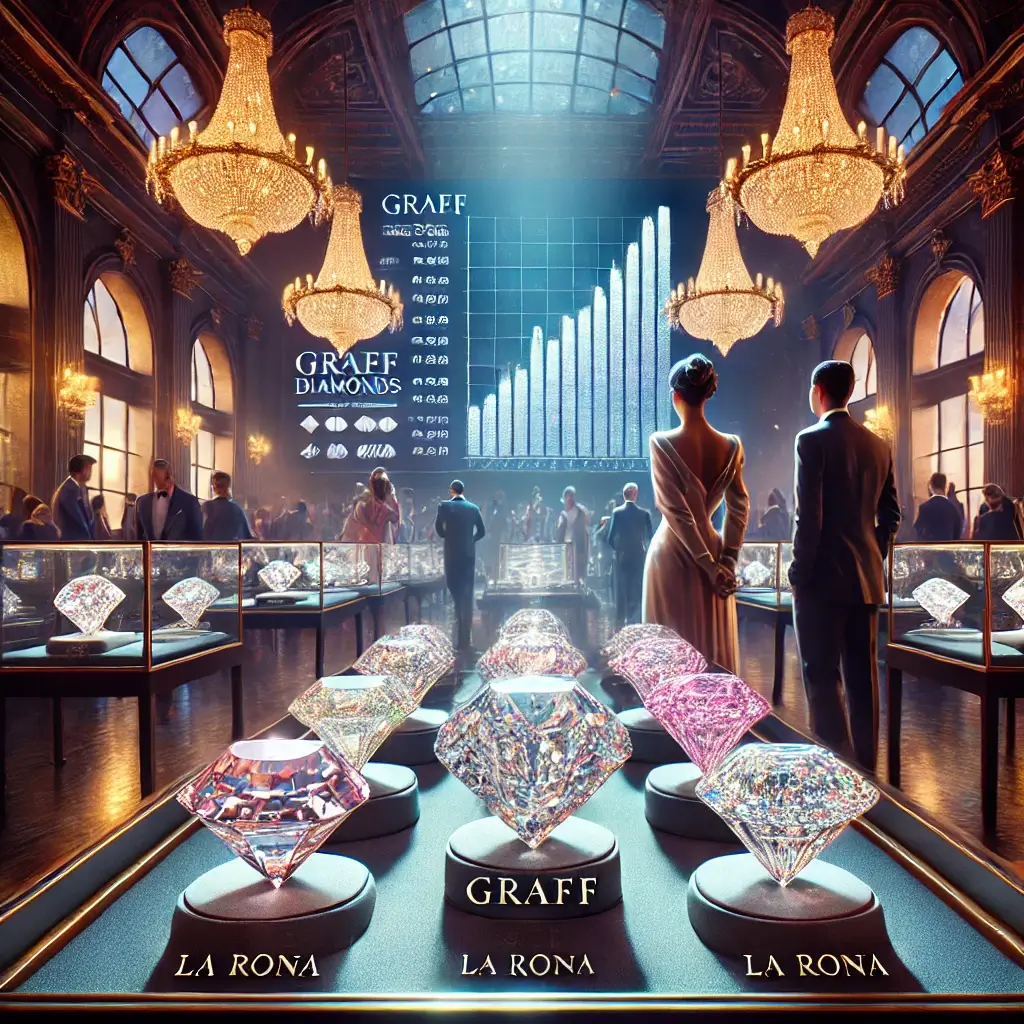

Graff Diamonds: The Strategic Alternative to Traditional Market Investments

Graff Diamonds represents more than luxury; it's an investment-grade asset offering tangible value, portability, and…

The German Precision Premium: How A. Lange & Söhne Timepieces Outperform Traditional Investments

A. Lange & Söhne watches combine German precision with investment potential, producing only 5,000 timepieces…

Beyond Volatility: Why Financial Advisors Are Recommending Cartier’s Tangible Asset Strategy

Discover how Cartier's historic collections offer tangible investment alternatives with consistent appreciation rates, backed by…

Dolce & Gabbana – Italian Luxury Fashion

From A-list Hollywood stars to top artists, Dolce & Gabbana has long been the go-to…

How Skimpflation Affects The Luxury Customer Industry

Skimpflation, or reducing quality while maintaining the same price, is a growing trend that significantly…

Quiet Luxury for High-end Brands

As silent luxury gains traction, conventional luxury firms are feeling the need to adapt. They…